The world market for collectible wine at auction continued to accelerate during 2017, reaching a year end total of $336.3 million, an advance of 12.48% over 2017, and the strongest performance since 2012. Totals in live auction sales, however, still lag significantly behind the last market peak in 2011, when over $440 million worth of wine traded hands. In total 85,516 lots were sold at auction, and prices continued to advance during throughout the year, driven largely by a massive run-up in prices for top Burgundy wines.

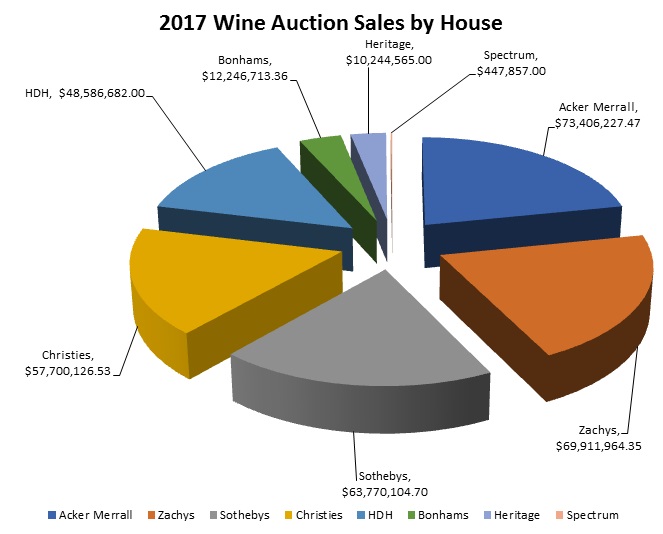

Among major auction houses, Acker Merrall closed out their season with a December sale in New York to finish the year with $73.4, the largest total for the year. Zachys sold the second-largest amount of wine, at $69.9 million, while Sotheby’s dropped to $63.8 million, while Christie’s rounded out the top four, ringing up $57.7 million if one includes the sales in Geneva and the Hospices de Beaune. While the Hospices sale is not always included in the tallies for the year because the vendor is a charitable organization, a buyer’s premium is charged and the sale has great commercial importance as a bellwether for the Burgundy market and it has thus been included here.

Consistent with recent years, the largest volume of wine has changed hands in U.S.-based sales, with 180.9 million or 53.8% of the total being sold there. This complex market continues to diversify, as Zachy’s held their first sale in Washington D.C., and HDH continued to make Chicago a strong center for wine sales. In 2017, they sold $48.6 million in Chicago to put them in fifth place globally in spite of the fact that this is their only sale site. Finally, between Bonham’s, Heritage and Spectrum, wine auction in California accounted for just over $13 million of the total. Outside the U.S., Hong Kong was the most important center, with nearly $100 million in sales – almost equivalent to the sales in New York. The U.K. accounted for $33.5 million in sales, while Christie’s sold $21.9 million in Europe, despite having apparently ceased all sales in Amsterdam and Paris.

Among the highlights of 2017 was a series of significant single-owner sales throughout the year. The spring season began with the third tranche of the Don Stott cellar at Sotheby’s which saw 87% of the lots sell above the high estimate. Six bottles of 1971 Roumier Musigny sold for more than $85,000 among several other world records for Roumier, Rousseau, Raveneau and others. Sotheby’s also sold the collection of an anonymous English vendor for US$ 9.3 million over the course of three sales spread across the U.S., U.K., and Hong Kong. Christie’s sold the cellar of Staffan Hansson quite successfully in New York and a consignment of venerable Burgundy from Bouchard Père et Fils, some dating to the 19th century in Geneva, while Acker, Merrall produced record results with single owner cellars from Wolfgang Grunewald and Sam Cook, and Zachys did an exemplary job for the cellar of Dr. Rob Caine in the course of their $7.9 million La Paulée sale.

The fall season opened with a Christie’s sale in Hong Kong featuring a small tranche of the renowned N.K. Yong collection and a further selection from the cellar of Yap Chee Meng. The action continued with an exceptional sale from Heritage in Beverly Hills that featured a Burgundy-heavy single owner sale from an anonymous California vendor, which was 100% sold. Acker, Merrall conducted a sale at in New York the next day featuring another selection from California collector Wilf Jaeger, and sales continued the following weekend in New York with a large sale by Zachys, headlined by consignments from well-known collectors Tawfiq Khoury and Gene Wong. Two somewhat more modest sales in London followed the events in New York, yet despite the lower totals, a single bottle of whisky, called The Dalmore 62 (The 12 Pointer), sold for £91,650 at Sotheby’s London. September concluded with Sotheby’s annual series of autumn auctions, which featured both a multi-vendor sale and a single-owner sale from renowned Fux restaurant in Austria.

The vigor of the market continued in the final quarter, with notable sales from Park Smith at Sotheby’s New York, where two jeroboams of 1990 DRC La Tâche sold for $43,000 each, and from collector Bill Graves at Acker New York, while Zachys managed to do quite well in Hong Kong with the collection of Eric Greenberg in spite of his past ties to counterfeit wine. The same anonymous English vendor who sold with Sotheby’s in the spring came back for another series with Christie’s in the fall, but in an embarrassing move for the department ended up withdrawing the sales once he had raised sufficient capital.

In category terms, Burgundy continued to spearhead the markets success. In Sotheby’s September sale, 1990 Romanée-Conti hit a remarkable new high of more than $44,000 per bottle. The same sale saw records for 1999 DRC La Tâche ($7,111/btl) and 2005 DRC Montrachet ($10,272/btl) among other wines. Elsewhere, Zachys also set a record price with a remarkable $67,600 for a jeroboam of 1971 La Tâche. Later in the season, a DRC Assortment case from the 1999 vintage sold for a record price of more than $76,000, while six bottles of Romanée-Conti from the same vintage made more than $108,000 in Acker, Merrall’s November Hong Kong sale, and the annual sale of wines to benefit the Hospices de Beaune in Burgundy rose to a new high of more than €13.5m / $16m, beating the total from 2015 to be the highest ever. Most of the leading indicators produced in Burgundy flattened out in the fourth quarter, although a few are up sharply, such as 1993 Leroy Musigny at $7552/bottle (+9.4%) and 1990 Rousseau Chambertin, which averaged $3901, +9.1% over last quarter. In aggregate, the movement of the leading indicators that we follow tracks with well-established trends, with the Burgundies ending November at +22.2% for the year.

Burgundy was far from the only gainer, however, as the Bordeaux-focus sale at Hart, Davis, Hart did well in November, with direct consignments from Château Montrose and Château Léoville-Las-Cases outperforming expectations, and a full barrel of 2016 Château Montrose selling for more than $119,000, or more than $400/btl. Elsewhere smaller consignments direct from Château Haut-Brion at Zachys and Château Lafite-Rothschild at Christie’s London both did well, although the average price of 1982 Lafite finished November at $2,758/btl, +1.8% over the third quarter, while 1990 Cheval Blanc averaged $905 per bottle, continuing to gain ground, +3.2% over the previous quarter.

Rarities from other regions also performed well, such as the double magnum of 1993 Cabernet Sauvignon from Screaming Eagle, which sold for more than $44,000 at Acker, Merrall. Standard bottles, however, showed less impressive gains, with bottles of the ’97 vintage flat at $3,920 (unchanged from the third quarter). The same was true for 1990 Rayas, trading at $1,408 per bottle, and 2007 Masseto, also holding steady at an average price of $652/btl.

In the primary market, the 2015 Burgundy campaign was an enormous success, in spite of shortages due to high demand. This is much-needed good news for Burgundy growers, who have suffered with particular severity in recent years from frost and hail. Burgundy lovers, however, can expect auction prices to continue to rise as the prices in the primary market continue to escalate. The Bordeaux market is also showing some strength given the fairly encouraging results of the 2016 futures campaign conducted earlier this year. Even as Burgundy prices escalate to new peaks, the market continues to pick up steam, and those buyers willing to look beyond the biggest names in Burgundy can still find relative value in classic wines as market successes continue to pull great collections to market. With an exciting line-up of new sales in the first quarter of 2018, it seems that there is no end in sight for the present bull market for collectible wine.