Prices of rare wine at auction continued to advance during 2017, driven largely by a massive run-up in prices for top Burgundy wines. [scroll down for English version] RVF China Winter 2017

RVF China Auction Roundup 2017 Winter clipAuthor: Charles Curtis MW

Wine Auction Market 2017 Year-End Review

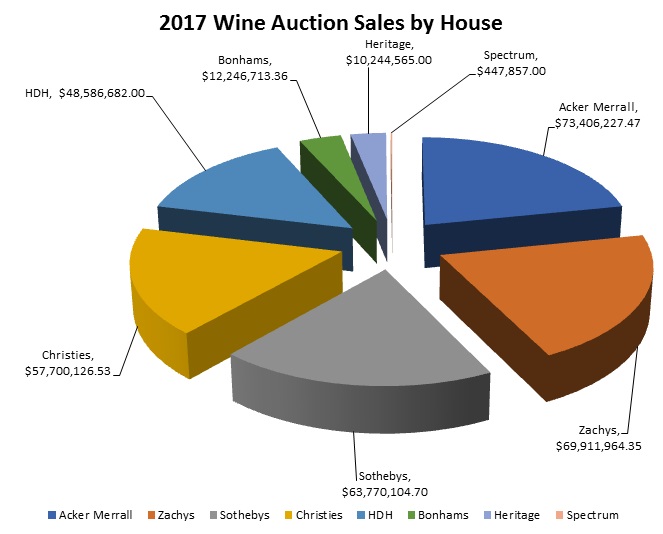

The world market for collectible wine at auction continued to accelerate during 2017, reaching a year end total of $336.3 million, an advance of 12.48% over 2017, and the strongest performance since 2012. Totals in live auction sales, however, still lag significantly behind the last market peak in 2011, when over $440 million worth of wine traded hands. In total 85,516 lots were sold at auction, and prices continued to advance during throughout the year, driven largely by a massive run-up in prices for top Burgundy wines.

Among major auction houses, Acker Merrall closed out their season with a December sale in New York to finish the year with $73.4, the largest total for the year. Zachys sold the second-largest amount of wine, at $69.9 million, while Sotheby’s dropped to $63.8 million, while Christie’s rounded out the top four, ringing up $57.7 million if one includes the sales in Geneva and the Hospices de Beaune. While the Hospices sale is not always included in the tallies for the year because the vendor is a charitable organization, a buyer’s premium is charged and the sale has great commercial importance as a bellwether for the Burgundy market and it has thus been included here.

Consistent with recent years, the largest volume of wine has changed hands in U.S.-based sales, with 180.9 million or 53.8% of the total being sold there. This complex market continues to diversify, as Zachy’s held their first sale in Washington D.C., and HDH continued to make Chicago a strong center for wine sales. In 2017, they sold $48.6 million in Chicago to put them in fifth place globally in spite of the fact that this is their only sale site. Finally, between Bonham’s, Heritage and Spectrum, wine auction in California accounted for just over $13 million of the total. Outside the U.S., Hong Kong was the most important center, with nearly $100 million in sales – almost equivalent to the sales in New York. The U.K. accounted for $33.5 million in sales, while Christie’s sold $21.9 million in Europe, despite having apparently ceased all sales in Amsterdam and Paris.

Among the highlights of 2017 was a series of significant single-owner sales throughout the year. The spring season began with the third tranche of the Don Stott cellar at Sotheby’s which saw 87% of the lots sell above the high estimate. Six bottles of 1971 Roumier Musigny sold for more than $85,000 among several other world records for Roumier, Rousseau, Raveneau and others. Sotheby’s also sold the collection of an anonymous English vendor for US$ 9.3 million over the course of three sales spread across the U.S., U.K., and Hong Kong. Christie’s sold the cellar of Staffan Hansson quite successfully in New York and a consignment of venerable Burgundy from Bouchard Père et Fils, some dating to the 19th century in Geneva, while Acker, Merrall produced record results with single owner cellars from Wolfgang Grunewald and Sam Cook, and Zachys did an exemplary job for the cellar of Dr. Rob Caine in the course of their $7.9 million La Paulée sale.

The fall season opened with a Christie’s sale in Hong Kong featuring a small tranche of the renowned N.K. Yong collection and a further selection from the cellar of Yap Chee Meng. The action continued with an exceptional sale from Heritage in Beverly Hills that featured a Burgundy-heavy single owner sale from an anonymous California vendor, which was 100% sold. Acker, Merrall conducted a sale at in New York the next day featuring another selection from California collector Wilf Jaeger, and sales continued the following weekend in New York with a large sale by Zachys, headlined by consignments from well-known collectors Tawfiq Khoury and Gene Wong. Two somewhat more modest sales in London followed the events in New York, yet despite the lower totals, a single bottle of whisky, called The Dalmore 62 (The 12 Pointer), sold for £91,650 at Sotheby’s London. September concluded with Sotheby’s annual series of autumn auctions, which featured both a multi-vendor sale and a single-owner sale from renowned Fux restaurant in Austria.

The vigor of the market continued in the final quarter, with notable sales from Park Smith at Sotheby’s New York, where two jeroboams of 1990 DRC La Tâche sold for $43,000 each, and from collector Bill Graves at Acker New York, while Zachys managed to do quite well in Hong Kong with the collection of Eric Greenberg in spite of his past ties to counterfeit wine. The same anonymous English vendor who sold with Sotheby’s in the spring came back for another series with Christie’s in the fall, but in an embarrassing move for the department ended up withdrawing the sales once he had raised sufficient capital.

In category terms, Burgundy continued to spearhead the markets success. In Sotheby’s September sale, 1990 Romanée-Conti hit a remarkable new high of more than $44,000 per bottle. The same sale saw records for 1999 DRC La Tâche ($7,111/btl) and 2005 DRC Montrachet ($10,272/btl) among other wines. Elsewhere, Zachys also set a record price with a remarkable $67,600 for a jeroboam of 1971 La Tâche. Later in the season, a DRC Assortment case from the 1999 vintage sold for a record price of more than $76,000, while six bottles of Romanée-Conti from the same vintage made more than $108,000 in Acker, Merrall’s November Hong Kong sale, and the annual sale of wines to benefit the Hospices de Beaune in Burgundy rose to a new high of more than €13.5m / $16m, beating the total from 2015 to be the highest ever. Most of the leading indicators produced in Burgundy flattened out in the fourth quarter, although a few are up sharply, such as 1993 Leroy Musigny at $7552/bottle (+9.4%) and 1990 Rousseau Chambertin, which averaged $3901, +9.1% over last quarter. In aggregate, the movement of the leading indicators that we follow tracks with well-established trends, with the Burgundies ending November at +22.2% for the year.

Burgundy was far from the only gainer, however, as the Bordeaux-focus sale at Hart, Davis, Hart did well in November, with direct consignments from Château Montrose and Château Léoville-Las-Cases outperforming expectations, and a full barrel of 2016 Château Montrose selling for more than $119,000, or more than $400/btl. Elsewhere smaller consignments direct from Château Haut-Brion at Zachys and Château Lafite-Rothschild at Christie’s London both did well, although the average price of 1982 Lafite finished November at $2,758/btl, +1.8% over the third quarter, while 1990 Cheval Blanc averaged $905 per bottle, continuing to gain ground, +3.2% over the previous quarter.

Rarities from other regions also performed well, such as the double magnum of 1993 Cabernet Sauvignon from Screaming Eagle, which sold for more than $44,000 at Acker, Merrall. Standard bottles, however, showed less impressive gains, with bottles of the ’97 vintage flat at $3,920 (unchanged from the third quarter). The same was true for 1990 Rayas, trading at $1,408 per bottle, and 2007 Masseto, also holding steady at an average price of $652/btl.

In the primary market, the 2015 Burgundy campaign was an enormous success, in spite of shortages due to high demand. This is much-needed good news for Burgundy growers, who have suffered with particular severity in recent years from frost and hail. Burgundy lovers, however, can expect auction prices to continue to rise as the prices in the primary market continue to escalate. The Bordeaux market is also showing some strength given the fairly encouraging results of the 2016 futures campaign conducted earlier this year. Even as Burgundy prices escalate to new peaks, the market continues to pick up steam, and those buyers willing to look beyond the biggest names in Burgundy can still find relative value in classic wines as market successes continue to pull great collections to market. With an exciting line-up of new sales in the first quarter of 2018, it seems that there is no end in sight for the present bull market for collectible wine.

Bull Market for Fine Wine Continues to Surge

Continuing to ride the seemingly endless ascent of prices for Burgundy wine, sales of fine and rare wine at live wine auctions in major worldwide markets finished the third quarter with a cumulative total of US$ 207.8 million, an advance of 7.58% over the same period last year. In the auction market, success breeds success, and the year so far has seen more lots coming to market (just over 55,000 this year compared to slightly more than 52,000 last year). It is likely that the strong sales this year have helped to draw out high quality wines from closely-held collections. The strong market has also buoyed the sell-through rate, which improved to an average of 93.4%, up from 92.3% last year.

Collectible California Wine

The era of the wine critic as king-maker is over, yet consumers still look for guidance… [scroll down for English version]

RVF China Collectible California Wine Fall 2017DRC Assortment Cases: What Are They Worth?

DRC assortment cases attract keen interest from Burgundy collectors. And why not? There is something attractive about getting an overview of the world’s greatest Pinot Noir all in one case. This initial excitement, however, begs two questions: Is it good value? And, once you’ve gotten the case in your cellar, what did you pay for each of those bottles? The short answer is that for valuation purposes one should consider the Assortment Case as one unit. If you plan to drink it, however, you might want to know how much each bottle is setting you back. This is how to make the calculation:

DRC assortment cases attract keen interest from Burgundy collectors. And why not? There is something attractive about getting an overview of the world’s greatest Pinot Noir all in one case. This initial excitement, however, begs two questions: Is it good value? And, once you’ve gotten the case in your cellar, what did you pay for each of those bottles? The short answer is that for valuation purposes one should consider the Assortment Case as one unit. If you plan to drink it, however, you might want to know how much each bottle is setting you back. This is how to make the calculation:

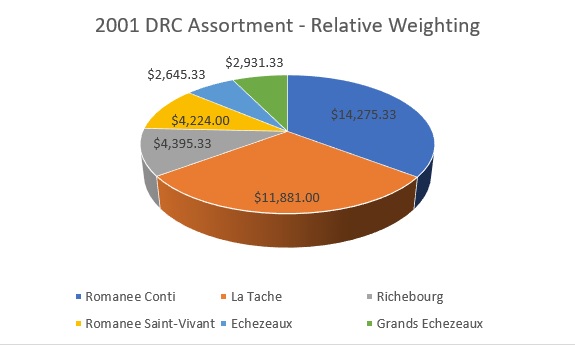

As with so many things, the answer is, “It depends”. We should begin with the caveat that the “DRC Assortment” is not a fixed thing. Initially begun in order to ensure steady sales of the “non-monopole” wines, it was meant to reflect the amount of the wines available at harvest. In an average year, there was one bottle of Romanée-Conti, three bottles of La Tâche, and two bottles each of Richebourg, Romanée-Saint-Vivant, Grands Echézeaux and Echézeaux. However, in some years there were only two La Tâche (as in 1983 and 1984); in other years (1987 – 1992 inclusive) there were there were three Romanée-Saint Vivant and only one Grands Echézeaux. In some years (such as 1984 and 1992) there were more than one variant. The last official 12 bottle assortment produced was the 2001. In 2002 there were two different six bottle assortments released; one for the U.S. and one for the E.U. Since that time the Domaine has produced assortments at the request of individual importers, but there has not been one standard release since this time.

Looking at 2001 as the last official DRC assortment, then, we note that the average price at auction of the assortment is $34,893.00, while if one purchased each of the components, the aggregate cost would be $32,285.00, resulting in a premium of roughly 8% for the assortment case. One finds furthermore that rounding to the nearest whole percentage that the bottle of Romanée-Conti accounts for 38% of the total, the three bottles of La Tâche account for 26% of the total; The two bottles of Romanée-Saint-Vivant and Richebourg each account for 11% of the cost; the Grands Echézeaux is 8% of the cost and the Echézeaux is 7% of the cost (weightings do not total 100% because of rounding – see above for exact figures).

These proportions change from vintage to vintage. For example, looking at the 1996 assortment, the average price at auction of $36,052.00 represents a premium of 8.29%, with the Conti valued at 38%, the La Tâche at 27%, the Richebourg at 10%, and the Romanée-Saint-Vivant, the Echézeaux and the Grands Echezeaux all at 8% of the total. However, the result is different in a year such as 1990 where the price of La Tâche is strong, and the proportions can look quite different. Here the average cost of a 1990 Assortment Case is $49,016.00, while the cost of the components would be $55,480.00, meaning the Assortment sells for a discount of almost 12% over the component parts; Romanée-Conti is 32.24% of the total, the three La Tâche actually amount to 32.76% of the total; Romanée-Saint-Vivant is 11.90%, Richebourg, 11.31%, Grands Echézeaux 6.49% and Echézeaux 5.31%.

This somewhat anomalous result is due to the fact that 1990 Romanée-Conti has come off its historic high price, while La Tâche 1990 is still appreciating. However, averaging each of these three vintages produces something like a balanced answer to this question: The discount for an assortment is 0.91%, thus it is more or less the same price, and the relative weighting seems appropriate, with Romanée-Conti being 35.4% of the total, La Tâche at 29.4% of the total; Richebourg, 10.9%, Romanée-Saint-Vivant, 10.5%; Grands Echézeaux 7.2%, and Echézeaux 6.6%.

Wine Auction Market Update H1 2017

The value of wine moving through the auction market in live sales at major commercial auctions increased slightly in the second quarter of 2017 to $104 million, a gain of 1.7%. This brings the total for the first half of the year to $152.3 million as compared to $144.2 million last year, a gain of 5.6%. The Q2 gain came in spite of the fact that this period last year saw the $21 million mega-sale by Bill Koch. Average sell through rates across all auction houses during the quarter were a very robust 94.6%.

The value of wine moving through the auction market in live sales at major commercial auctions increased slightly in the second quarter of 2017 to $104 million, a gain of 1.7%. This brings the total for the first half of the year to $152.3 million as compared to $144.2 million last year, a gain of 5.6%. The Q2 gain came in spite of the fact that this period last year saw the $21 million mega-sale by Bill Koch. Average sell through rates across all auction houses during the quarter were a very robust 94.6%.

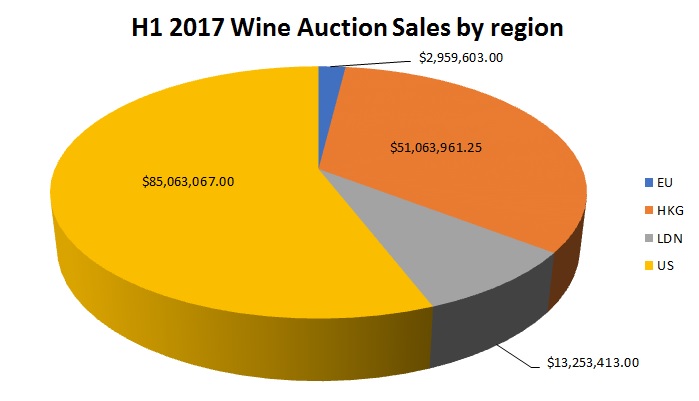

Consistent with recent experience, the U.S. sales totals led the market with just over $85 million in turnover, accounting for 55.8% of the total auction market. Due to the anomaly of the Koch sale, however, the total was slightly less than last year, at $86.7 million. Within the U.S., the bulk of the sales (65.8%) were done in New York, while the HDH sales held in Chicago accounted for 28.6%, and several small sales in California accounted for 5.6%

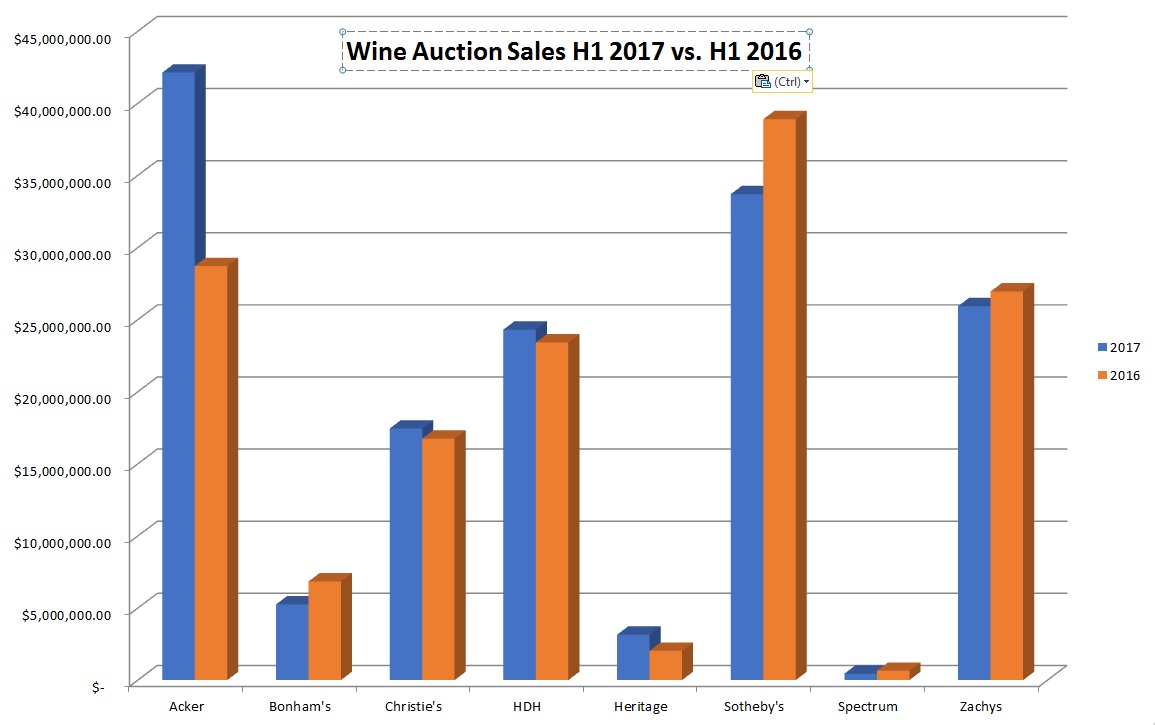

Auction House Acker, Merrall & Condit was the big winner in the first half of the year, with total sales rising to $42.1 million from last year’s $28.7 million, an increase of +46.7% Acker’s nearest competitor was Sotheby’s, who hammered down $33.7 million of wine in H1, a drop of -30.2% compared to last year when they led the field. Zachys ($25.9 million) edged out HDH ($24.3 million) for third place, and Christie’s came in fifth at $17.4 million. To put matters in perspective, however, Christie’s global sales were more than double the next three houses combined (Bonham’s, Heritage and Spectrum).

Auction House Acker, Merrall & Condit was the big winner in the first half of the year, with total sales rising to $42.1 million from last year’s $28.7 million, an increase of +46.7% Acker’s nearest competitor was Sotheby’s, who hammered down $33.7 million of wine in H1, a drop of -30.2% compared to last year when they led the field. Zachys ($25.9 million) edged out HDH ($24.3 million) for third place, and Christie’s came in fifth at $17.4 million. To put matters in perspective, however, Christie’s global sales were more than double the next three houses combined (Bonham’s, Heritage and Spectrum).

Burgundy sales continued to be very strong. Zachys Wine Auctions reported Burgundy to be the largest category in their auctions during the period. Prices for top Burgundy also continued to move forward: the average bottles of ’90 Romanée Conti rose to $17,900, + 2.8% for the quarter, while 1999 La Tâche increased to $5,100, +8.6% in the same period. Young vintages also performed well: Liger-Belair’s La Romanée was up +17.8% from last quarter and a robust +28.8% from the 2016 average. All of the Burgundy wines have advanced from their 2016 average prices; a bottle of 1993 Leroy Musigny realized more than $8,000, and 1996 Coche Corton Charlemagne sold consistently for over $5,000 per bottle. In some instances, the spread between the high and low price for top Burgundy over the past year has been marked: Sotheby’s New York sold a single bottle of 1990 Romanée Conti for $31,850 in May, while Acker, Merrall realized just $14,020 in their January Hong Kong sale. In April of this year, two bottle of 2005 DRC Montrachet made over $17,300, while a bottle sold at Spectrum in December sold for just over $3,900.

Interestingly, Acker, Merrall reported that Bordeaux wines led their sales in the first half of 2017 for the first time in several years. All of the leading indicators for the Bordeaux market have continued to move forward during the period, albeit at a slower pace than Burgundy. The price for ’82 Lafite is up 4.4% for the quarter and 5.7% for the year to an average of $2695. Unlike the ’82 Lafite, which experienced such a bubble in 2011, the 1989 Haut-Brion continues to make steady advances, to $1,671 in Q2 from $1,569 in 2016 and $1,520 in 2011, while 2000 Pétrus continues to gain as well. Counter-examples include 1963 Quinta do Noval Nacional at -27.6% to an average of $3,978, and 1999 Guigal Côte Rôtie La Mouline -16.4% against the 2016 average to $552/btl.

Significant single-owner sales during the period included the third tranche of the Don Stott cellar at Sotheby’s, which saw 87% of the lots sell above the high estimate. Six bottles of 1971 Roumier Musigny sold for more than $85,000 among several other world records for Roumier, Rousseau, Raveneau and others. Sotheby’s also sold the collection of an anonymous English vendor for US$ 9.3 million over the course of three sales spread across the U.S., U.K., and Hong Kong. Christie’s sold the cellar of Staffan Hansson quite successfully in New York and a consignment of venerable Burgundy from Bouchard Père et Fils, some dating to the 19th century in Geneva, while Acker, Merrall produced record results with single owner cellars from Wolfgang Grunewald and Sam Cook, and Zachys did an exemplary job for the cellar of Dr. Rob Caine in the course of their $7.9 million La Paulée sale.

In the primary market, sales of 2015 Burgundy have been delirious, with widespread shortages in spite of a rather generous vintage. This is good news for Burgundy growers, and welcome as yields in 2016 were sharply limited by frost, hail, and rot depending on the particular locality. Auction buyers can expect this limited supply to translate into increased prices on the secondary market, however, as new consumers turn to auctions to satisfy their Burgundy needs. The Bordeaux market is also showing moderate strength on the back of a fairly robust 2016 futures campaign. Quality in 2016 was superb, and while some châteaux tested the market by raising prices, others held the line and delighted buyers with the prospect of an eventual bargain. While recent statistics suggest that total worldwide wine consumption is flat to slightly down, it seems that the thirst for the good stuff is stronger than it has been in some time.

Cracking the Code: Buying Wine in London

Being able to locate the rarest vintage and the most sought-after wines on a moment’s notice is only a dream for most … [scroll down for English version]

RVF China Summer 2017Campania March 2017

Champagne and Burgundy Continue to Surge

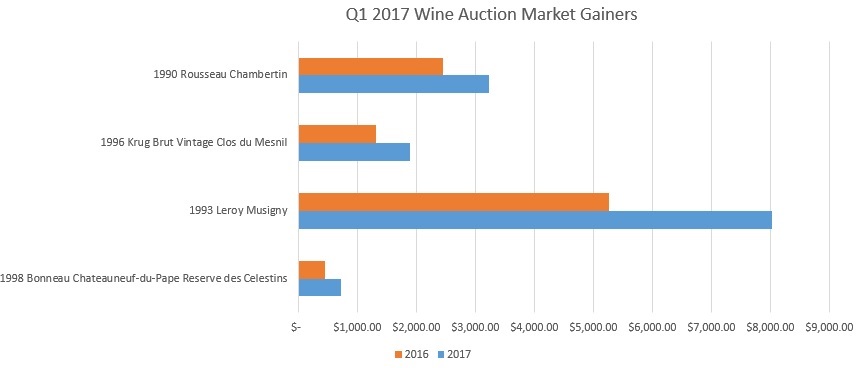

The Champagne category performed well in the first quarter of 2017, as indicated by prices for 1996 Krug Clos de Mesnil, +43.8% over 8 trades in the first quarter. Prices for the regular 1996 Krug Brut and the 1990 Dom Perignon were up more modestly at +7.3% and +11.1% on a broader base.

Top Bordeaux wines were flat or down moderately in the period: ’89 Haut-Brion was -0.9%, ’82 Lafite was +1.3% and 1990 Cheval was +3.8%, while 2000 Petrus was -9.2% and ’89 Lynch Bages was -13.9%

Growth continued for many Burgundy wines. The biggest gainer was ’93 Leroy Musigny at +52.5%, but there was only one trade during the period (in the Acker Grunewald sale), although other vintages of the same wine also showed sharp growth and Leroy generally has been very buoyant in spite of fairly high prices. 1990 Rousseau Chambertin continued to show good growth at +31.9%, and even younger vintages, such as the 2010 Liger-Belair La Romanee was +9.4%. Some of the less well-known wines showed slower growth however: no ’09 Cathiard Malconsorts came to market, but the ’05 vintage was +3.7% in the period, and the ’05 Fourrier Clos Saint-Jacques was +0.9%.

Results were mixed for white Burgundy. 1996 Coche Corton Charlemagne showed comparatively modest growth at +2.9%, but 2005 DRC Montrachet was +57.5% over 11 bottles trading hands, with 9 of them at Acker’s Chinese New Year sale.

Elsewhere, prices were generally higher for Rhone wines. ’90 Rayas was +14.5%, and ’98 Bonneau Celestins showed the most growth of any indicator in the period at +62.8%. Others, however, had dropped: ’78 La Chapelle was -1.4% (no ’61 traded hands), and the ’99 La Mouline was -17.7% with 50 bottles trading hands. Italian wine drooped slightly: ’07 Masseto was -6.5% in spite of a strong showing at the Sotheby’s New York sale, and ’90 Monfortino was -4.9%.

New World wines were mixed. ’01 Grange was +4.3%, but ’97 Screaming Eagle was -3.8%, and ’94 Dominus was -5.7%, while Port continued to show modest growth, with ’63 Nacional +7.6% and ’77 Taylor’s at +4.0%.

Wine auction market sales sharply higher

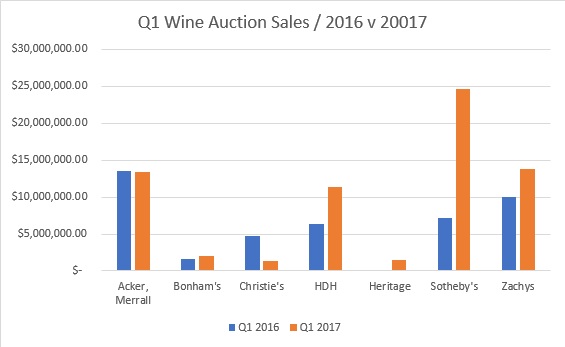

The wine auction market showed ruddy good health in the first quarter of 2017 after a somewhat slow initial start. Total volume through the marketplace was $68.1 million, as compared to $43.5 million during the same period last year. The average lot value this year is considerably higher, at $3,938 this year as compared to $3,168 last year, and the total number of lots coming to sale is also up – from 15,001 in Q1 last year to 19,111 this year, with three more sales on the calendar. In addition, the average sell-through rate was more robust, with 92.52% of lots offered finding buyers as compared to 91.75% last year.

Sotheby’s continued to lead the market, with a total of $24.6 million in the quarter over seven sales, with an average sell-through rate of 93.8%. This total included a three-sale set of single owner sales all from the same anonymous vendor that totaled $9.3 million. While not the magnitude of last year’s Koch sale, this was still a significant sale, and their success with big single owner sales continues to help business getting on this front. They have recently announced the sale of another tranche from the Don Stott collection for May 20th, with a presale estimate of $2m – $2.8m.

Second place was won by Zachys at $13.8 million, driven in part by their very successful La Paulée auction, worth $7.9 million. The average sell through rate of 98.3% outperformed the marketplace. This is a very strong result, particularly given the fact that there was only one sale in Hong Kong and one sale in New York during the quarter. Zachys just edged out Acker, Merrall, who sold $13.5 million over four sales, while HDH sold $11.3 million in the quarter with their two Chicago sales, selling every one of their lots for what some would call a “white glove” result.

Christie’s and Bonhams were both slower than last year, albeit off a smaller base. Dallas-based Heritage organized a sale in Beverly Hills, while last year they did not during the first quarter.