Wine Auction Market Update H1 2017

The value of wine moving through the auction market in live sales at major commercial auctions increased slightly in the second quarter of 2017 to $104 million, a gain of 1.7%. This brings the total for the first half of the year to $152.3 million as compared to $144.2 million last year, a gain of 5.6%. The Q2 gain came in spite of the fact that this period last year saw the $21 million mega-sale by Bill Koch. Average sell through rates across all auction houses during the quarter were a very robust 94.6%.

The value of wine moving through the auction market in live sales at major commercial auctions increased slightly in the second quarter of 2017 to $104 million, a gain of 1.7%. This brings the total for the first half of the year to $152.3 million as compared to $144.2 million last year, a gain of 5.6%. The Q2 gain came in spite of the fact that this period last year saw the $21 million mega-sale by Bill Koch. Average sell through rates across all auction houses during the quarter were a very robust 94.6%.

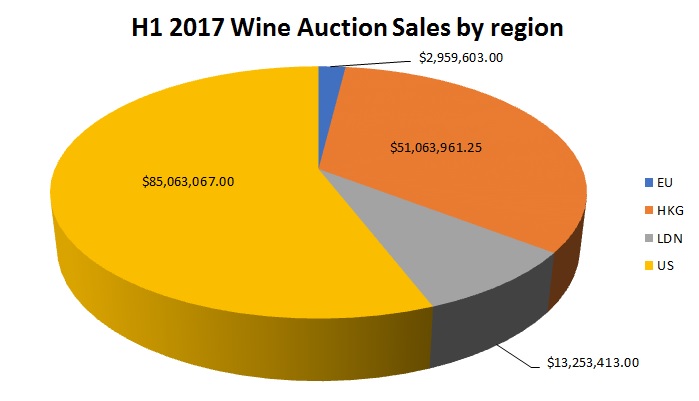

Consistent with recent experience, the U.S. sales totals led the market with just over $85 million in turnover, accounting for 55.8% of the total auction market. Due to the anomaly of the Koch sale, however, the total was slightly less than last year, at $86.7 million. Within the U.S., the bulk of the sales (65.8%) were done in New York, while the HDH sales held in Chicago accounted for 28.6%, and several small sales in California accounted for 5.6%

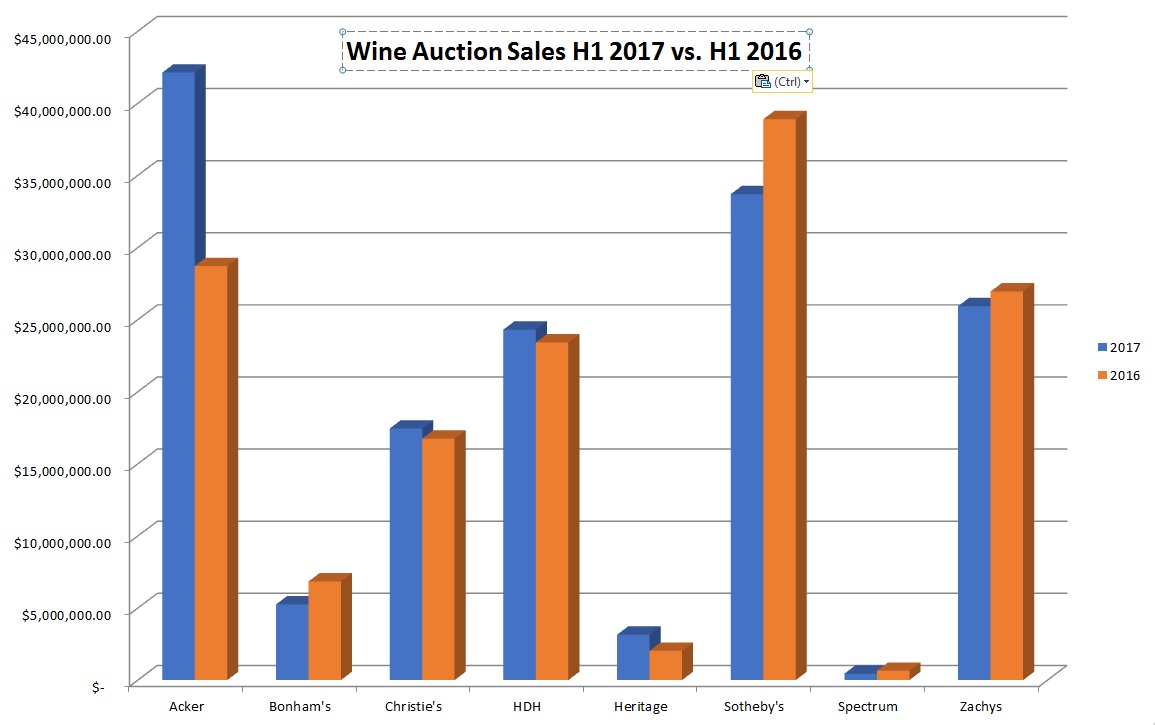

Auction House Acker, Merrall & Condit was the big winner in the first half of the year, with total sales rising to $42.1 million from last year’s $28.7 million, an increase of +46.7% Acker’s nearest competitor was Sotheby’s, who hammered down $33.7 million of wine in H1, a drop of -30.2% compared to last year when they led the field. Zachys ($25.9 million) edged out HDH ($24.3 million) for third place, and Christie’s came in fifth at $17.4 million. To put matters in perspective, however, Christie’s global sales were more than double the next three houses combined (Bonham’s, Heritage and Spectrum).

Auction House Acker, Merrall & Condit was the big winner in the first half of the year, with total sales rising to $42.1 million from last year’s $28.7 million, an increase of +46.7% Acker’s nearest competitor was Sotheby’s, who hammered down $33.7 million of wine in H1, a drop of -30.2% compared to last year when they led the field. Zachys ($25.9 million) edged out HDH ($24.3 million) for third place, and Christie’s came in fifth at $17.4 million. To put matters in perspective, however, Christie’s global sales were more than double the next three houses combined (Bonham’s, Heritage and Spectrum).

Burgundy sales continued to be very strong. Zachys Wine Auctions reported Burgundy to be the largest category in their auctions during the period. Prices for top Burgundy also continued to move forward: the average bottles of ’90 Romanée Conti rose to $17,900, + 2.8% for the quarter, while 1999 La Tâche increased to $5,100, +8.6% in the same period. Young vintages also performed well: Liger-Belair’s La Romanée was up +17.8% from last quarter and a robust +28.8% from the 2016 average. All of the Burgundy wines have advanced from their 2016 average prices; a bottle of 1993 Leroy Musigny realized more than $8,000, and 1996 Coche Corton Charlemagne sold consistently for over $5,000 per bottle. In some instances, the spread between the high and low price for top Burgundy over the past year has been marked: Sotheby’s New York sold a single bottle of 1990 Romanée Conti for $31,850 in May, while Acker, Merrall realized just $14,020 in their January Hong Kong sale. In April of this year, two bottle of 2005 DRC Montrachet made over $17,300, while a bottle sold at Spectrum in December sold for just over $3,900.

Interestingly, Acker, Merrall reported that Bordeaux wines led their sales in the first half of 2017 for the first time in several years. All of the leading indicators for the Bordeaux market have continued to move forward during the period, albeit at a slower pace than Burgundy. The price for ’82 Lafite is up 4.4% for the quarter and 5.7% for the year to an average of $2695. Unlike the ’82 Lafite, which experienced such a bubble in 2011, the 1989 Haut-Brion continues to make steady advances, to $1,671 in Q2 from $1,569 in 2016 and $1,520 in 2011, while 2000 Pétrus continues to gain as well. Counter-examples include 1963 Quinta do Noval Nacional at -27.6% to an average of $3,978, and 1999 Guigal Côte Rôtie La Mouline -16.4% against the 2016 average to $552/btl.

Significant single-owner sales during the period included the third tranche of the Don Stott cellar at Sotheby’s, which saw 87% of the lots sell above the high estimate. Six bottles of 1971 Roumier Musigny sold for more than $85,000 among several other world records for Roumier, Rousseau, Raveneau and others. Sotheby’s also sold the collection of an anonymous English vendor for US$ 9.3 million over the course of three sales spread across the U.S., U.K., and Hong Kong. Christie’s sold the cellar of Staffan Hansson quite successfully in New York and a consignment of venerable Burgundy from Bouchard Père et Fils, some dating to the 19th century in Geneva, while Acker, Merrall produced record results with single owner cellars from Wolfgang Grunewald and Sam Cook, and Zachys did an exemplary job for the cellar of Dr. Rob Caine in the course of their $7.9 million La Paulée sale.

In the primary market, sales of 2015 Burgundy have been delirious, with widespread shortages in spite of a rather generous vintage. This is good news for Burgundy growers, and welcome as yields in 2016 were sharply limited by frost, hail, and rot depending on the particular locality. Auction buyers can expect this limited supply to translate into increased prices on the secondary market, however, as new consumers turn to auctions to satisfy their Burgundy needs. The Bordeaux market is also showing moderate strength on the back of a fairly robust 2016 futures campaign. Quality in 2016 was superb, and while some châteaux tested the market by raising prices, others held the line and delighted buyers with the prospect of an eventual bargain. While recent statistics suggest that total worldwide wine consumption is flat to slightly down, it seems that the thirst for the good stuff is stronger than it has been in some time.

Comments