DRC assortment cases attract keen interest from Burgundy collectors. And why not? There is something attractive about getting an overview of the world’s greatest Pinot Noir all in one case. This initial excitement, however, begs two questions: Is it good value? And, once you’ve gotten the case in your cellar, what did you pay for each of those bottles? The short answer is that for valuation purposes one should consider the Assortment Case as one unit. If you plan to drink it, however, you might want to know how much each bottle is setting you back. This is how to make the calculation:

DRC assortment cases attract keen interest from Burgundy collectors. And why not? There is something attractive about getting an overview of the world’s greatest Pinot Noir all in one case. This initial excitement, however, begs two questions: Is it good value? And, once you’ve gotten the case in your cellar, what did you pay for each of those bottles? The short answer is that for valuation purposes one should consider the Assortment Case as one unit. If you plan to drink it, however, you might want to know how much each bottle is setting you back. This is how to make the calculation:

As with so many things, the answer is, “It depends”. We should begin with the caveat that the “DRC Assortment” is not a fixed thing. Initially begun in order to ensure steady sales of the “non-monopole” wines, it was meant to reflect the amount of the wines available at harvest. In an average year, there was one bottle of Romanée-Conti, three bottles of La Tâche, and two bottles each of Richebourg, Romanée-Saint-Vivant, Grands Echézeaux and Echézeaux. However, in some years there were only two La Tâche (as in 1983 and 1984); in other years (1987 – 1992 inclusive) there were there were three Romanée-Saint Vivant and only one Grands Echézeaux. In some years (such as 1984 and 1992) there were more than one variant. The last official 12 bottle assortment produced was the 2001. In 2002 there were two different six bottle assortments released; one for the U.S. and one for the E.U. Since that time the Domaine has produced assortments at the request of individual importers, but there has not been one standard release since this time.

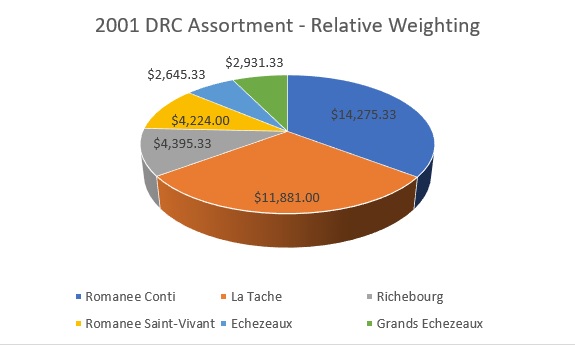

Looking at 2001 as the last official DRC assortment, then, we note that the average price at auction of the assortment is $34,893.00, while if one purchased each of the components, the aggregate cost would be $32,285.00, resulting in a premium of roughly 8% for the assortment case. One finds furthermore that rounding to the nearest whole percentage that the bottle of Romanée-Conti accounts for 38% of the total, the three bottles of La Tâche account for 26% of the total; The two bottles of Romanée-Saint-Vivant and Richebourg each account for 11% of the cost; the Grands Echézeaux is 8% of the cost and the Echézeaux is 7% of the cost (weightings do not total 100% because of rounding – see above for exact figures).

These proportions change from vintage to vintage. For example, looking at the 1996 assortment, the average price at auction of $36,052.00 represents a premium of 8.29%, with the Conti valued at 38%, the La Tâche at 27%, the Richebourg at 10%, and the Romanée-Saint-Vivant, the Echézeaux and the Grands Echezeaux all at 8% of the total. However, the result is different in a year such as 1990 where the price of La Tâche is strong, and the proportions can look quite different. Here the average cost of a 1990 Assortment Case is $49,016.00, while the cost of the components would be $55,480.00, meaning the Assortment sells for a discount of almost 12% over the component parts; Romanée-Conti is 32.24% of the total, the three La Tâche actually amount to 32.76% of the total; Romanée-Saint-Vivant is 11.90%, Richebourg, 11.31%, Grands Echézeaux 6.49% and Echézeaux 5.31%.

This somewhat anomalous result is due to the fact that 1990 Romanée-Conti has come off its historic high price, while La Tâche 1990 is still appreciating. However, averaging each of these three vintages produces something like a balanced answer to this question: The discount for an assortment is 0.91%, thus it is more or less the same price, and the relative weighting seems appropriate, with Romanée-Conti being 35.4% of the total, La Tâche at 29.4% of the total; Richebourg, 10.9%, Romanée-Saint-Vivant, 10.5%; Grands Echézeaux 7.2%, and Echézeaux 6.6%.

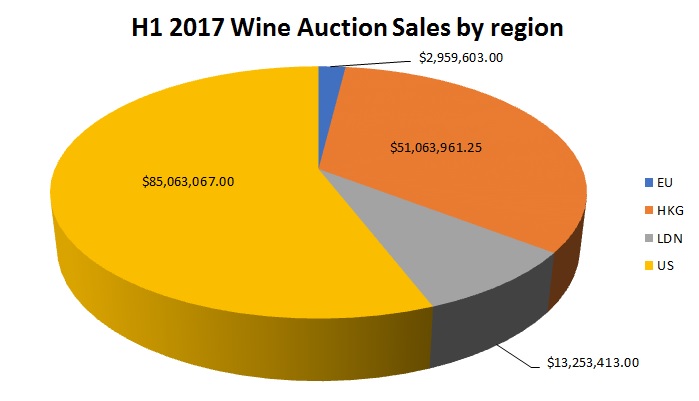

The value of wine moving through the auction market in live sales at major commercial auctions increased slightly in the second quarter of 2017 to $104 million, a gain of 1.7%. This brings the total for the first half of the year to $152.3 million as compared to $144.2 million last year, a gain of 5.6%. The Q2 gain came in spite of the fact that this period last year saw the $21 million mega-sale by Bill Koch. Average sell through rates across all auction houses during the quarter were a very robust 94.6%.

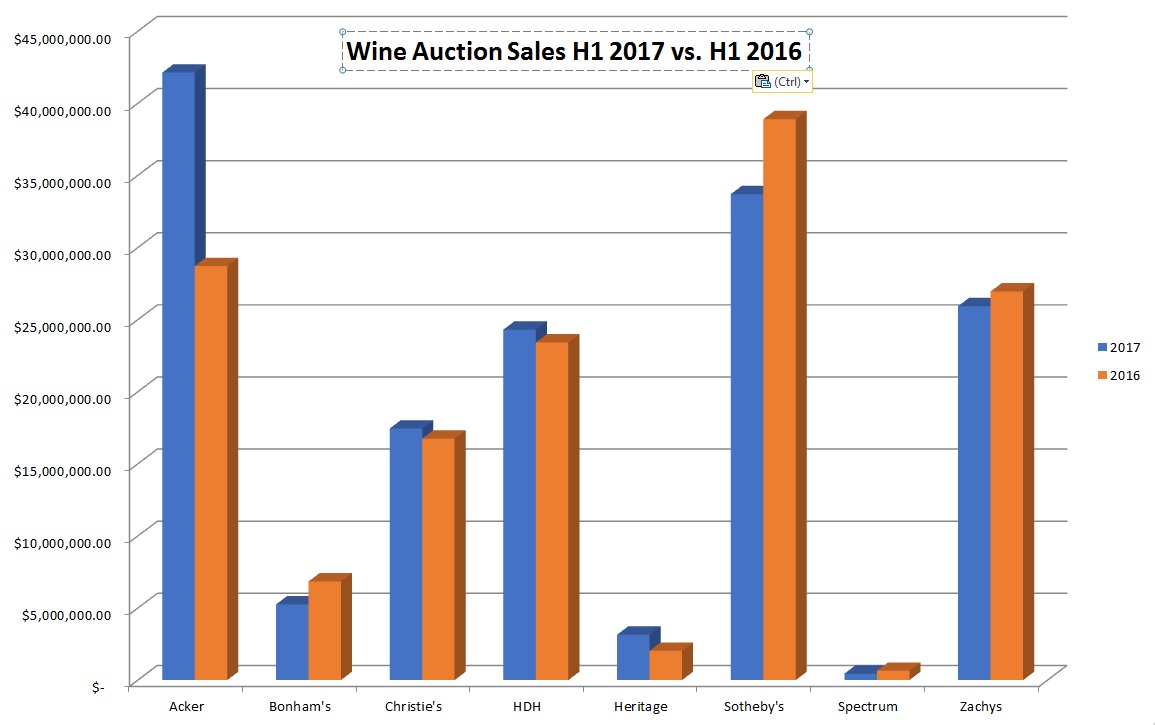

The value of wine moving through the auction market in live sales at major commercial auctions increased slightly in the second quarter of 2017 to $104 million, a gain of 1.7%. This brings the total for the first half of the year to $152.3 million as compared to $144.2 million last year, a gain of 5.6%. The Q2 gain came in spite of the fact that this period last year saw the $21 million mega-sale by Bill Koch. Average sell through rates across all auction houses during the quarter were a very robust 94.6%. Auction House Acker, Merrall & Condit was the big winner in the first half of the year, with total sales rising to $42.1 million from last year’s $28.7 million, an increase of +46.7% Acker’s nearest competitor was Sotheby’s, who hammered down $33.7 million of wine in H1, a drop of -30.2% compared to last year when they led the field. Zachys ($25.9 million) edged out HDH ($24.3 million) for third place, and Christie’s came in fifth at $17.4 million. To put matters in perspective, however, Christie’s global sales were more than double the next three houses combined (Bonham’s, Heritage and Spectrum).

Auction House Acker, Merrall & Condit was the big winner in the first half of the year, with total sales rising to $42.1 million from last year’s $28.7 million, an increase of +46.7% Acker’s nearest competitor was Sotheby’s, who hammered down $33.7 million of wine in H1, a drop of -30.2% compared to last year when they led the field. Zachys ($25.9 million) edged out HDH ($24.3 million) for third place, and Christie’s came in fifth at $17.4 million. To put matters in perspective, however, Christie’s global sales were more than double the next three houses combined (Bonham’s, Heritage and Spectrum).