Where Have We Been, Where Are We Headed?

Although 2019 registered a decline of 6.6% in wine auction sales from 2018, a careful observer will likely discern that it was another big year for the category, with global sales at live auctions totaling $437.8 million. This total is the third-largest in the history of wine auctions. It followed an exceptional year in 2018, where the aggregate of all live wine auction sales by international houses was $468.9 million, exceeding the previous market peak in 2011 when live sales totaled $442.5 million. Sales in the aggregate were thus more than $30 million less, but to complete the picture, one needs to factor in the 2018 auction in Geneva from the estate of Henri Jayer, which totaled over $34 million. This single-owner sale was more than the difference between 2018 and 2019 globally. Correcting for this one anomalous sale shows a small increase over 2018 in most categories.

Initially, it appeared to many that the market would begin to cool in 2019 – how could it not? But the strength of the buyer’s demand remained nearly unchecked. Sales appeared to slow at the end of the second quarter going into the summer, but after a reasonably short build in Q3 the pace in the final quarter was as steady as ever. High prices and excellent results brought more property out of cellars as long-time collectors took some profits from the market, and conservative buyers had few opportunities in November and December as prices continued to bump against record highs. These results were particularly surprising against the backdrop of the civil unrest in Hong Kong. While the streets were empty, buyers migrated online and sales continued.

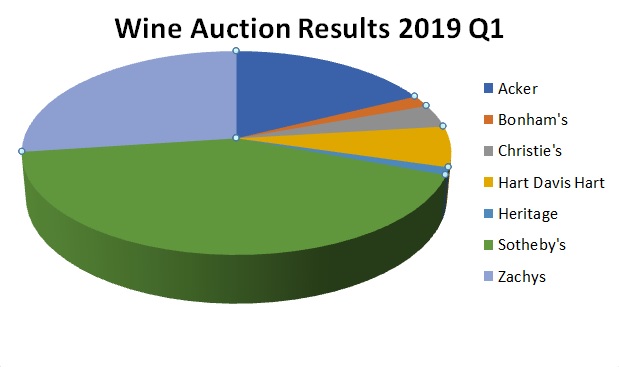

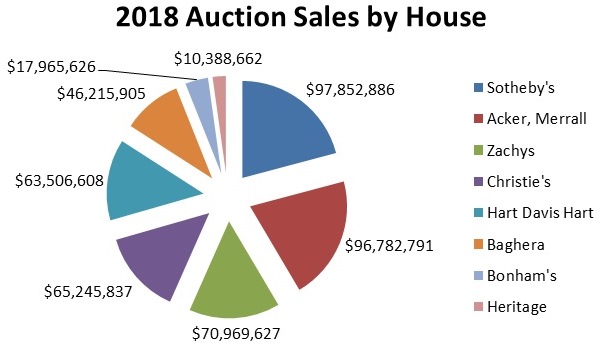

During this highly-charged year, there were significant shifts in the dynamics between the major players in the industry. Sotheby’s remained the number one wine auction house by volume by a much larger margin than last year, with $116.5 million in sales, up +16% from $97.9 million in 2018. Zachy’s was in second place at $101.2 million in sales, an impressive 29.9% increase from their third-place finish in 2018. Acker, however, suffered a loss of more than 20%, slipping from second to third place with sales of $79.8 million. The rest of the field also sold less than they did in 2018. HDH gave up only 5.6% to move up in the rankings from fifth place to fourth, although Baghera dropped from second place in 2018 to a distant last place in 2019, due to the effect of their 2018 Jayer sale. In 2019 they organized a lovely sale of wines from René Engel, but despite the attraction to specialist collectors, there was nothing like the interest generated by the Jayer sale.

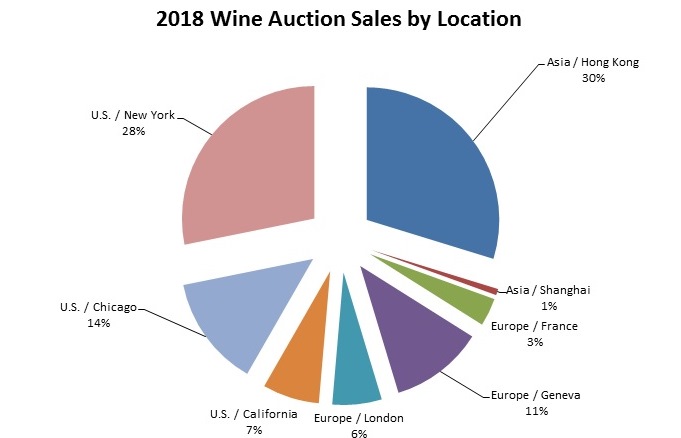

The absence of the numbers from the Jayer sale impacted the regional balance as well. Sales in the U.S. continued to grow and were up 4.9% to $222.7 million. New York sales totaled $152.7 million, with the rest split between Chicago and California. Despite the unrest in Asia, Hong Kong also continued to grow, up 2.7% to $147 million, despite the lack of a Christie’s wine sale in Shanghai. Balancing these increases was a decline in European sales by 67.4%. Although totals grew slightly in the U.K. with the inclusion of the $12.3 million in whisky sales in Scotland, results elsewhere were down. Geneva was down in sales more than 500% due to the Jayer sale that occurred in 2018. The Hospices de Beaune sale in Burgundy also dropped 14.1% to $14 million. This is normal variation, however, and due to lower volumes available for sale: there were 589 barrels this year compared to 828 last year. However, the average price per barrel increased more than 32% than in 2018 on the heels of a robust reception for the 2019 Burgundy vintage.

Prices for Burgundy wine have been high. One factor fueling the increases has been scarcity. Wine production is tiny – just 1.4 million hectoliters in total across the entire region, 4.1% of the French output by volume. Of this already small figure, premier crus account for 10.2% of total production, and grands crus, just 1.4%. Despite the low production, Burgundy has an outsized impact. At €1.7 billion last year, sales of Burgundy account for about 20% of all French wine exports overall. In the auction market, the dominance of Burgundy is even more pronounced, with most auction houses reporting more than 40% of their sales or more are Burgundy wine. Sotheby’s announced that for 2019, 50% of their turnover in the wine category came from Burgundy wine, and 22% of the total was from Domaine de la Romanée-Conti alone. Pessimists have expected Burgundy prices to drop for some time. As of Q1 of 2020, the movement of our leading indicators have been mixed but indicate that this is broadly true. Romanée-Conti 1990 was up 4.5% for the year to more than $24,500/btl, but Q1 saw a decline of 27.8% to $23,500. Prices are not low across the board, however: 1993 Leroy Musigny continued to show startling gains: +19.3% to more than $15,500/btl last year, and two bottles sold in Q1 for $20,570 each. Younger vintages such as 2010 La Romanée from Liger-Belair also continued to rise, albeit at a slower pace (+0.9% in Q1 after being +1.3% in 2019, ending at just above $5,700/btl), while white Burgundy appeared to suffer, with 1996 Corton Charlemagne from Coche-Dury -19.3% to slightly over $5,000/btl, after rising to more than $5,800/btl in 2019.

Bordeaux has also been dropping across the board in the first quarter: ’90 Cheval Blanc declined by 2.0% compared to the same period last year. The powerhouse ’89 Haut-Brion was also down 2% and 1982 Lafite dropping by nearly one-third in reasonably active trading to average just over $2,500/btl, and 2000 Pétrus was down over 10% to average $3,900/btl. Leading indicators for other wines showed either modest growth or mixed results. Champagne continued to show moderate growth, while the Rhône and California showed mixed results, with big-ticket items such as ’97 Screaming Eagle and ’90 Conterno Monfortino declining (-11.2% and -17.5% respectively). In comparison, less expensive Masseto and ’94 Dominus rose moderately (+7.7% and +6.8% respectively).

The overall market for wine in the U.S. has continued to expand through the end of February. Sales were up +3% compared to the previous 12 months, according to analytics firm bw166. Premium wines (in this context meaning priced to the consumer between $10 – $20/btl) during this period increased by 5.3%. At the same time, sales direct to consumers increased by 15% in value in calendar 2018, according to the Silicon Valley Bank. Imported wine has kept market share despite tariffs, rising 6% through February 2020. Nevertheless, there are obstacles to continued expansion: wine drinkers are aging, and the Millennial generation is not picking up demand as many had hoped. Instead, it seems that they are consuming spirits and hard seltzer, a category that has seen spectacular growth. It is also difficult to assess the extent of changes due to the COVID-19 confinement. Recent data suggests that on-trade sales have declined by 80% while sales to the off trade have increased by 30%.

Burgundy and Champagne enjoyed record years in 2019 with exports increasing by value (and by volume for Burgundy wine). For Bordeaux wines, results are somewhat more mixed. They have enjoyed a run of strong vintages, and the 2018 vintage was among the best. The 2018 primeurs campaign (which took place between April and July of 2019) saw strong sales for top-rated wines among the well-known producers, but lesser-known names struggled. Merchants also had difficulty selling through their purchases given uncertainties in the U.K. over Brexit and problems in Hong Kong due to rioting. Compounding matters for the Bordelais is the rather unfortunately unfashionable nature of their wines at present, which depressed prices in both the primary market and the auction market. Producers have responded by limiting the size of their initial release to buoy prices.

In the final analysis, it appears that despite several adverse conditions, the market for collectible wine still turned in a very creditable performance in 2019. Although there was nothing comparable to the Jayer sale to push the numbers over the top, the market continued to show resilience.

Moving forward into the first quarter of 2020, however, we see the market for collectible wine transformed from where it was just three months ago. Early January is normally an exciting time in the auction world. Fifteen years ago, there were no sales during this time and little demand from Asia. With Hong Kong opening itself to wine sales in 2008, sales in advance of Chinese New Year celebrations became common and lucrative. This year, Acker managed a 944-lot sale that earned $7.3 million on January 11th, but this was the last live sale that took place in Asia this year. Neither Zachys, Christie’s, nor Sotheby’s staged a Q1 sale in this high-revenue venue. By the end of Chinese New Year in China, the COVID-19 virus had erupted, disrupting life for everyone there, although sales continued apace in the U.S. and Europe. February sales in the U.S. included a $9.7 million auction by Acker in New York, and a $5.9 million auction by Hart Davis Hart in Chicago, all with high sell-through rates. The trend continued into March, with Zachys executing a sale of over $9.9 million during the first weekend in March (99% sold), among other auctions, including a $3.3 million auction at Bonham’s California that was 99.7% sold. Each of these showed reliable results, due in part to the fact that here in the United States, 25% tariffs on wine remain in place. Although the sales that have occurred have been unexpectedly strong, they have been less frequent, particularly in Asia, and the overall volume through the market has been about half of what it has been in the first quarter of the last two years.

Acker held a sale in Hong Kong on March 27th that could prove a template for the next six months. They are organizing an auction in real-time, with bids taken online, over the phone, or as absentee bids. They assure me that the absentee bidding is up to the pace of previous sales. Since absentee and internet bids usually account for as much as 85% of the volume in a typical wine sale, this is encouraging. The fact that many parts of Asia are now starting to come out of lockdown helps encourage optimism. Conversations with merchants and auctioneers suggest that demand there is strong. Jamie Pollack, head of department at Zachys, notes that in the March 7th sale, Asian bidders won 39% of all lots in the March La Paulee sale. They have scheduled an auction as well in the same real-time online format as Acker. We expect that this format will be the dominant method of auctioning wine for the next six months. Despite the unprecedented trading conditions, it seems that demand is still there and that the fine wine market continues to function, albeit at a lower level. Through the end of the 1st quarter, sales at live auctions totaled $49 million, as compared to $119.7 million in the first quarter of 2019 (by comparison, the Q1 total in record-setting 2018 was $92.5 million). It appears that the market has been adapting to new conditions. Participation in live online sales in the first week of April seems to indicate that wine continues to sell, although the hammer prices are hovering around the reserves. Given the lead time required to put a sale together, however, this is logical, as the estimates for these sales were done 30 – 60 days ago.

One imagines that moving forward into the second quarter that estimates will tend to follow hammer prices on a downward trajectory, and those buyers able to take advantage of a softening market will likely find bargain-priced wine. Savvy buying means buying on the way down, but knowing what to pay, and collectors that can repeatedly recalibrate during these times will come out of them with a handsome collection that in time should appreciate sharply.