2018 Fine Wine Auction Market Analysis

Executive Summary

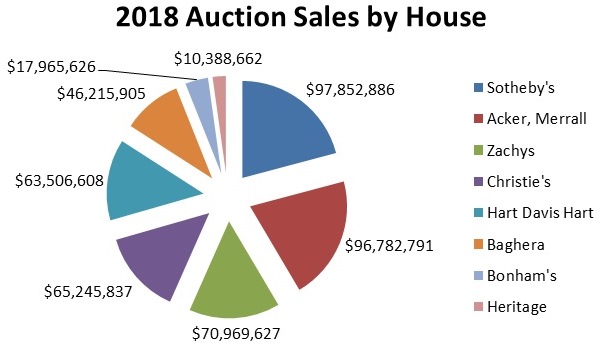

2018 was an unprecedented year in wine auction sales, and market conditions continue to show remarkable vigor. Sales at live auctions in 2018 totaled more than $468.9 million, exceeding the previous peak of the market in 2011, when live sales totaled $442.5 million. This was largely driven by extremely strong demand for Burgundy wines and by resurgent demand from Asia. A strong roster of sales already in the first half of 2019 and anecdotal conversations with auction house personnel also suggest that this trend will continue at a minimum through the first half of 2019. Although volume was dominated by U.S. sales, many of the lots sold here actually went to bidders based in Asia, and the role of Asian collectors in the worldwide fine wine trade is indisputable.

Spiraling Sales Totals

The wine department at Sotheby’s produced the highest-grossing sales total at $97.9 million, a 53.4% increase over last year. Sotheby’s sales were also well-distributed, with frequent smaller sales in London and three sales in New York, but the totals were essentially driven by their two successful series of three sales in Hong Kong in March and September of this year that netted US $ 29.1 million and US $14.5 million respectively, a large share of which was produced by “The Philanthropist’s Cellar” sold by an anonymous Asian collector to benefit charity. This was followed by the first half of the sale of wines from the estate of Jerry Perenchio, billionaire former CEO of Univision, which made $ 6.7m, and a multi-vendor sale that garnered another $6.1m. The New York sequel to the sale of the Perenchio estate was the largest US sale for Sotheby’s. Sotheby’s forte has always been the exceptional single-owner sale, however, and in October they have pulled off another coup, selling 100 lots of extremely rare DRC directly from the personal cellar of Robert Drouhin. Prices generally were extraordinary—as one would expect for wine of this rarity with this provenance. Even with this consideration, results exceeded market expectations. As an example, two bottles of Romanée-Conti sold for $496,000 and $558,000 respectively. Sotheby’s wine retail has also made news recently, as the Hong Kong office has sold a collection of seven methuselahs (6 liter bottles) for more than US$ 1.5m. Single owner sales late in the season included the 7th Earl of Durham, Burgundy from Jim Clark’s cellar, and the wines of an unnamed European Connoisseur. Selling in London, Hong Kong and New York, their twenty-three they offered twenty-three sales, by far the largest number of any auction house.

Sotheby’s sales were nearly matched by their wine-only competitor, Acker, Merrall & Condit, whose sales brought in a total of $96.8 million, an increase of 31.8% over last year. Eschewing a London saleroom and lacking the draw of their competitors art departments, Acker focuses on monthly sales that alternate between Hong Kong and New York. In 2018 they offered sixteen sales. Their single-owner consignments are often anonymous, such as “The Lifetime Collection”, “Billion-Dollar Baby”, and the “Everest Collection”. The named sale from noted collector Wilf Jaeger was an exception to this. Also important components of the Acker, Merrall sales are the direct consignments from a number of illustrious Burgundy producers, including Chateau de la Tour, Clos de la Chapelle, Domaine Duroché, Drouhin, Faiveley, Fourrier, Haegelen-Jayer, Hudelot-Noellat, Lamarche, Comte Liger-Belair, Hubert Lignier, Meo-Camuzet, Bernard Moreau and Domaine Roulot. In today’s super-heated Burgundy market their dominance in this type of sale is an important competitive advantage, although the sale direct from Domaine Comte Georges de Vogüé at Christie’s Hong Kong was perhaps the “ex-domaine” highlight of the spring season.

As extraordinary as these series of sales by the top two houses were, however, they were almost eclipsed sense by totals from Baghera Auctions in Geneva. This newcomer, headed up by former Christie’s staff, chalked up sales of $46.2 million in only two sales, one in June and one in December. The June sale featured the last of the wine from the personal cellar of legendary Burgundy winemaker Henri Jayer. Here a mere 215 lots earned in excess of US$ 34 million. This consignment came directly from the daughters of Henri Jayer and was comprised of the special bottles he had set aside for his wife Marcelle, who passed away in 2013. The top lot in the sale was a vertical in magnum of 15 vintages of his iconic Vosne-Romanée Cros Parantoux that sold for US$ 1.2 million; six magnums of the ’99 Cros Parantoux sold for US$ 530,000, and a single bottle of 1986 Richebourg sold for more than US$ 50,193. In total the sale produced more than four times the presale estimate. The early December auction by Baghera was a very large collection of wines from the Domaine de la Romanée Conti in December also outperformed expectations, and demonstrates the ability of Baghera to disrupt the settled order of the market. This sale and others in the final month of the year lifted the wine auction market to new heights.

Like Acker, Merrall, the Scarsdale, NY-based Zachys sells wine only, and limits its sales to the U.S. and to Asia. In 2018, they sold a total of nearly $71 million to garner third place in the volume stakes. Zachys relies on fewer but larger sales. Their two-day event in December, for example, was headlined by the impressive Klaus Umek sale. Many of the top Zachys sales, however, such as “The Vault” were anonymous in 2018, although this house has produced its share of notable single-owner sales in the past.

The other main international auction house is Christie’s, who have scaled back their presence in the wine auction world in recent years, as they ceased sales in Amsterdam and Paris, and scaled them back in Geneva, London, New York, and Hong Kong. In spite of this retrenchment, they sold $65.2 million worth of wine in 2018, an advance of 13.1% over last year. In addition to the de Vogüé sale mentioned earlier, they organized several landmark sales of Madeira and older German wines, as well as a sale of the highly collectible Chinese distilled spirit Maotai, held in Shanghai.

Following Christie’s very closely in sales totals was the wine-only, Chicago-based auctioneer Hart Davis Hart, with a total of $63.5 million, achieved solely with sales in Chicago. They often present significant named collections such as the Fox Cellar and the Harris collection, and are known for their exceptionally high sell-through rate. Like Zachys, they rely on a smaller number of very large sales, organizing seven throughout 2018.

Not to be outdone, London-based Bonham’s increased sales 46.7% over 2017, albeit from a smaller base of $12.2 million. They have a strong niche position in the auctioning of rare spirits, and their sales of the Peter Blake edition of 1926 Macallan ($1.01 million) and the Valerio Adami-designed bottle of the same spirit ($1.04 million) raised eyebrows, although both fell short of the extraordinary result of the unique Michael Dillon-designed bottle sold at Christie’s in November which made more than $1.5 million. The only auction house that did not reap big volume gains in 2018 was Dallas-based collectibles auctioneer Heritage, whose $10.2 million total was an advance of just 1.4% over 2017.

U.S. Sales Remain Strong

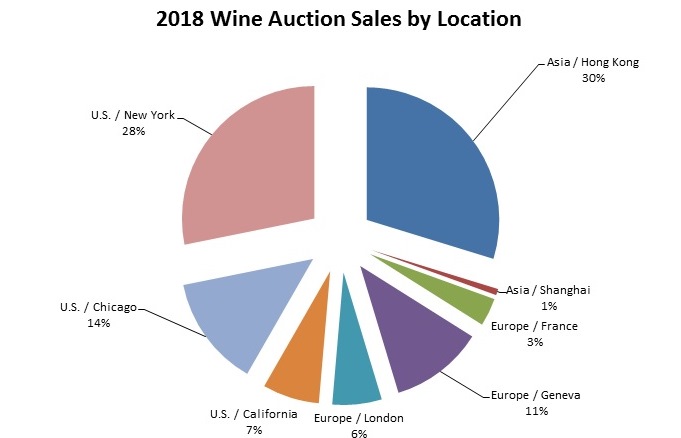

In 2018, the U.S. maintained its position as the leading market for wine auctions, with $211.9 million sold through year end. The bulk of this total ($132.1 million) was sold in New York, with the Chicago total of $63.5 million from HDH in second place, and California-based sales a distant third with $16.3 million.

However, it is important to recognize that the wine trade is increasingly global in nature, and although there are more sales happening out of U.S. sales rooms, many of the buyers in these sales are based in Asia. Sotheby’s Wine 2018 Market Report tells us that 63% of their wine buyers are based in Asia, as compared to only 24% in the US, 11% in Europe and 2% in South America.

Asia’s important position can also be seen in the establishment of Hong Kong as the second fine wine powerhouse, with sales of $139.5 million. The big surprise this year was the emergence of Europe as a strong competitive force. This is certainly the case if one can include the UK in this calculation. The two markets combined totaled $113.9 million, with nearly half of that attributable to sales in Geneva. However, London sales were also strong, at $44.5 million, advancing by almost 1/3 over last year’s total of $22.5 million. In addition to the international houses, Zachys and Acker both now have full time staff based in France, and the combined totals the Baghera sales, the larger-than-normal volumes in Christie’s Hospices de Beaune and the robust sales of spirits in the UK (such as the Christie’s London sale of a single bottle of 1926 Macallan for US$ 1,528,800), will likely continue to push sales in the Eurozone to new heights.

Burgundy Continues to Dominate

The somewhat conservative fine wine market has anticipated a leveling off of Burgundy prices given recent increases, but this was patently not the case in 2018, and initial results in 2019 confirm this observation. Recent communication from auction house personnel confirm that Burgundy has now an approximately 40% share of trade in the secondary market, even though the amount of wine produced in Bordeaux is nearly four times as much: Burgundy produces 1.41 million hectoliters of wine on average, while Bordeaux in an average year will produce 5.25 million hl. Sotheby’s reported in their year-end press release that Burgundy has a 42% share this year and an average bottle price of $1,700 at auction. Even more astonishing, they report that sales of Domaine de la Romanée-Conti accounted for $24 million, equivalent to 21% of their combined retail and auction trade in total. They continue to point out that this is more than Pétrus, Lafite, and Latour combined.

Bordeaux has nonetheless continued to benefit from the rising tide, and many iconic bottles are now selling above the 2011 high water mark. Private communications suggest that these two categories together continue to make up 90% of the secondary trade in fine wine, and the only thing to have changed is the seismic shift between Bordeaux and Burgundy. All the rest of the world (and the rest of France) makes up one-tenth of the market at best. Individual returns can be strong, however, even if the volume through the market is small, and champagne continues to offer significant returns, while many Italian wines and wines of the Rhône valley are essentially flat. Certain U.S. producers can be counted on to appreciate, but the overall market for California wine is fairly soft, as are the markets for sweet wines such as Port and Sauternes. Madeira has seen a revival of interest, but the numbers are still fairly small.

Our proprietary “Leading Indicators” serve to illustrate these trends. The most obvious is the strong demand for Burgundy. Prices for 1990 Romanée Conti had appeared to soften in the first half of the year, but averaged $25,800 per bottle during the fall easong, with a high price of over $33,000/btl at Sotheby’s Hong Kong. 1999 DRC La Tâche rose to an average of more than $7,200 for the year, netting more than $10,000/btl at the Baghera sale in December. 1993 Leroy Musigny was also firmly into five-digit territory, with an average price of more than $12,500/btl for the year and 1990 Rousseau Chambertin climbing more than 23% for the year to finish with an average price of more than $5,100/btl.

The strongest performance from a Bordeaux château among the Leading Indicators was the 1990 Cheval Blanc, +16.6% for the year to sell at an average price of more than $1,000/btl, and some results, such as the $1,447 at Christie’s London being above historic high prices for this wine. For some wines, such as the 1989 Haut-Brion, the the average price for 2018 was highest annual average price recorded, while for many others including 2000 Pétrus and 1986 Mouton that situation is fast approaching.

In other categories, perhaps the strongest performance is in collectible spirits. Tim Triptree, International Director of Christie’s Wine Department, estimates the total size of the secondary market in spirits at $50 million in 2018 and is bullish on continued growth. According to Triptree, “Growth in the market for rare whisky is the best performing sector of the auction industry…” Other segments did not fare as well: Rhône prices seemed to stagnate during the year, with the exception of the very strong ’90 Rayas ($1,547, +12.6%), although it had been even higher at mid-year. A similar trajectory was seen for Italian icons such as ’07 Masseto which finished up 12.4% at an average $744/btl, although it gave up a bit of ground from the first half of the year when it averaged $813/btl.

The Retail Market

Demand for the 2016 Burgundy vintage reached a fever pitch early this spring as a combination of low yields and high quality squeezed already tight allocations and convinced many merchants to raise prices. While some domaines held the line on price increases, there were few bargains to be had for the end consumer, but the average quality level on view at the Grands Jours de Bourgogne was particularly encouraging, both for reds and for whites. Luckily for all concerned, 2017 and 2018 are closer to “normal” yields, thereby reducing one reason for inflationary pressure on prices. In spite of this, however, the annual sale of Burgundy at the Hospices de Beaune achieved a record result in 2018, with 828 barrels (a record yield) producing $16.9 million, a record aggregate total, demonstrating that Burgundy prices are going only up in the foreseeable future, in spite of the last two generous harvests. In spite of increased volumes in the 2017 vintage, prices for the first offers of 2019 appear to advance on those for the 2016s to the disappointment of many collectors. This has apparently not, however, had the effect of lowering demand for these wines.

The 2017 Bordeaux primeur campaign, on the other hand, was difficult. This vintage in Bordeaux was severely reduced by frost, with many properties losing half their crop, and the weather during the growing season was variable, with heavy rain at the end of June followed by a hot, dry August and then rain in early September. This played havoc with the grow cycle of the vine, but fortunately the weather cleared at the end of the season, and pessimism was not universal. The commercial side of the campaign, was perhaps less adroitly handled, and in spite of generally modest quality, prices were not uniformly lower, leading to widespread disillusionment on the part of the merchants and consequently little enthusiasm on the part of the consumer. The Bordelais seem quite excited about the quality of their 2018 crop, and this may result (if history is any guide) in a new surge in prices from this region.

In the broader wine market, sales of premium wines continue to grow at a modest pace, and initial returns suggest a gain of +1.2% over last year, to a total of 408 million cases of all wine, domestic and imported, continuing a 24 year trend. However, volume trends tell only part of the story, as the wholesale value of wine moved forward by +3.7% for the year to end at $70 billion. Somewhat ominously, the seven largest wine companies sold 70% of all the wine in the country in 2018, and sales for these companies declined 0.7% for the year in aggregate. However, as last year, the Direct-to-Consumer channel grew to $3 billion, +12% for the year, led by Sonoma County and Oregon and Washington states. This channel now represents 10% of all off-trade sales and expected to continue to grow.

Comments