Q1 Auction Results 2019

Defying all expectations, the market for collectible wine continues to surpass expectations with its vibrancy and depth. As regular observers of the category will recall, 2018 was a record year for collectible wine, and during the first quarter the totals have surpassed those for the same period of 2018, with $124.7 million in sales at live auctions in the first three months of the year, across 20 sales spanning the UK, the US, and Hong Kong, although this total includes the multi-vendor sale that Sotheby’s organized on the 1st of April, since this formed part of their spring season of sales at the Hong Kong Convention and Exhibition Centre.

The first quarter was dominated by Sotheby’s, with their exceptional “Trans-cend-ent” collection that went up for sale in Hong Kong. The sale included over 16,000 bottles from an anonymous Asian collection, including 250 lots of wine from the Domaine de la Romanée-Conti, and an astonishing total of more than 600 lots of wine from Coche-Dury, a quantity that is reputed to be greater than the stocks that exist at the winery. The highest-grossing lots were three twelve-bottle lots of 1990 Romanée-Conti, which sold for $347,520 each, or just a bit more than $28,000 per bottle. A generous price, but it is worth noting that this is, however, below the record price set by Sotheby’s in 2017. Overall, however, the sale surpassed all expectations, with the wines of Mouton-Rothschild and Krug both coming in at double the pre-sale estimate. In aggregate, the sale reached almost $30 million US against a pre-sale estimate of $19 million.

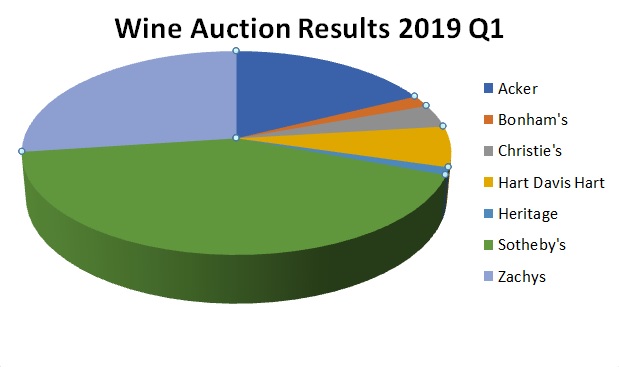

This was far from the only notable sale in the quarter. The Zachys La Paulée sale featured over 2000 lots that hammered collectively for $13.6 million, which followed their January season opener in Hong Kong that raised $12.4 million from 1199 lots. Zachys wrapped up their first quarter with a $7.9 million sale direct from the cellars of Lafite-Rothschild. Overall, Sotheby’s led the market with $52.6 million in sales during the quarter, followed by Zachys, with $33.8 million, and Acker came in third place with $22 million spread across four sales. Geographically, the Sotheby’s series weights the balance heavily in favor of Hong Kong, with $66.3 million in sales in the first quarter, as compared to $48.9 million in the U.S., and $7.2 million sold into the London market.

Live auctions in London were relatively quiet in this period, with four sales in the course of the first quarter. The first of these was a single-owner sale at Sotheby’s called “A Superlative Swiss Cellar” on January 23rd. At nearly 1,000 lots, it was a fairly large sale that was 87.3% sold by lot. The top lot was an original wooden case of six bottles of Leroy Richebourg that made just over £29,000 against an estimate of £16,000 – £20,000, in spite of three bottles having signs of seepage, a record price at the time. The second and third largest grossing lots were magnums and bottles of 2000 Mouton Rothschild. These, however, hammered within the estimate and were sharply eclipsed in the March Christie’s sale.

The second sale of the quarter was held on February 21st at Bonhams, where 576 lots brought just over £568,000 (71.7% sold). The top lot was nine bottles of 1982 Pétrus, which sold for £25,000 or £29,875 with premium, just at the low estimate. Three bottles of the ’61 Pétrus also sold at the low estimate for £17,925 all in.

The third and fourth sales were both done on the 20th of March. Sotheby’s sale of 966 lots produced £2.3 million (89.6% sold), while the Christie’s sale of 334 lots produced £1.3 million (99.4% sold). The top lot at the Sotheby’s sale was a jeroboam of 1989 DRC Montrachet that made just over £31,000 with premium, above the high estimate. The entire list of top ten lots was of an interesting composition: all were all from the Domaine de la Romanée-Conti, and all bar one were Montrachet. All bar two sold to Asian clients. The sale included an anonymous collection called “A Remarkable Cellar”, and a selection from the Cartier Collection, sold to benefit Cartier Philanthropy. The Christie’s sale also included a charitable element, as a selection of Burgundies donated by the estates themselves were sold to benefit the Maison Jacques Copeau, a theatrical institute in Burgundy. The top lot of the sale was a dozen 1988 Romanée-Conti which sold for £232,740 with premium, just below the low estimate. Christie’s London has produced the top three prices achieved at auction for this wine, but this latest result is considerably below the bar they set in their October 2018 sale.

The strength of the market has tended to bring wine from private cellars. Much of this is fueling the auction market, although merchants and brokers can also be strong competitors. Some will buy stock outright, while others will offer the wines on consignment “subject to confirmation”. Many of these are priced at or near the market price as established by the auction market, although some seem more speculative. We saw in the first quarter a 12 bottle case of 1990 Gentaz Côte Rôtie for £38,000; a 12 bottle case of 2005 Rousseau Chambertin priced at £58,000; and 6 bottle cases of Haut Côtes de Nuits Blanc “vinifié par DRC” for £5,000.

In order to analyze category dynamics, we have developed a system of looking at a list of leading indicators selected from each category that will give us a more concrete idea of which way the market is moving. We use global averages across all sales sites to get a more solid idea than anecdotal examples of outlying exceptional results would give us. As one might expect in the current market, Burgundy continues to lead the market. 1990 Romanée-Conti picked up 16.6% to average $27,368 in the first quarter (global averages given in US$), while 1990 Rousseau Chambertin picked up 11% to average $5,671 in the same period, up from $5,111 for the full year 2018. Among white wines, 1996 Coche-Dury Corton Charlemagne picked up 18.1% to average $6,013 in the first quarter, and 2005 DRC Montrachet gained 7.5% to average $8,878. The truly spectacular result, however, was 1993 Leroy Musigny which sold for an average of $18,396 in the first quarter (up from $12,559 in 2018), largely on the strength of Sotheby’s “Trans-cend-ent” sale. However, not every Burgundy rose in price – 1999 DRC La Tâche lost 5.4% to average $6,229 in the period.

Bordeaux also continued to appreciate. Most notably, 1982 Lafite picked up 19.4% to average $3,742 during the period, and 1989 Haut-Brion continued its hot streak to end up just shy of $2,000 per bottle in the first quarter, although 2000 Pétrus grew only 1% for an average of $4,492.

Results elsewhere were mixed: Guigal’s La Mouline and Jaboulet’s La Chapelle lost 1.3% and 1.1% respectively, while 1990Rayas grew 8.1% to average $1,824/btl. In the New World, Screaming Eagle 1997 lost nearly 10% of its value to end at $4,302, but 2001 Grange grew 16.4% to end at $461/btl, and ’07 Masseto lost 12.5% of its value, wile 1990 Monfortino from Giacomo Conterno picked up a healthy 28.4% to end at $2,104/btl in the first quarter.

Executive summary: a good time to sell Burgundy, to buy Bordeaux, and to choose your other wines carefully.

Comments